Investing in the stock market can seem overwhelming, especially for those who are new to it. With so many options available, it’s essential to understand the basics of investing in stocks and bonds before making any decisions. In this article, we’ll break down the key differences between stocks and bonds, helping you make informed investment choices.

What are Stocks?

Stocks, also known as equities, represent ownership in a company. When you buy stock, you’re essentially buying a small piece of that company. Stocks are traded on stock exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ. By owning stocks, you become a shareholder and are entitled to a portion of the company’s profits, known as dividends.

There are several types of stocks, including:

- Common stocks: These are the most common type of stock and represent ownership in a company.

- Preferred stocks: These stocks have a higher claim on assets and dividends than common stocks but do not give shareholders voting rights.

- Growth stocks: These stocks are expected to grow rapidly in the short term.

- Dividend stocks: These stocks pay out a portion of the company’s profits to shareholders in the form of dividends.

- Value stocks: These stocks are undervalued and can provide long-term growth potential.

What are Bonds?

Bonds, also known as fixed-income securities, represent debt obligations between investors and companies or governments. When you buy a bond, you’re essentially lending money to the issuer with the expectation of receiving regular interest payments and the return of your principal investment.

Bonds are unique in that they represent a contract between the investor and issuer, with the investor providing funds in exchange for regular interest payments and the ultimate return of their principal investment. There are several types of bonds, including:

- Government bonds: These bonds are issued by governments to finance their activities.

- Corporate bonds: These bonds are issued by companies to finance their activities.

- Municipal bonds: These bonds are issued by local governments to finance public projects.

- High-yield bonds: These bonds offer higher yields but are also riskier than other types of bonds.

- International bonds: These bonds are issued by international companies or governments.

Key Differences between Stocks and Bonds

While both stocks and bonds are investment instruments, there are several key differences between them.

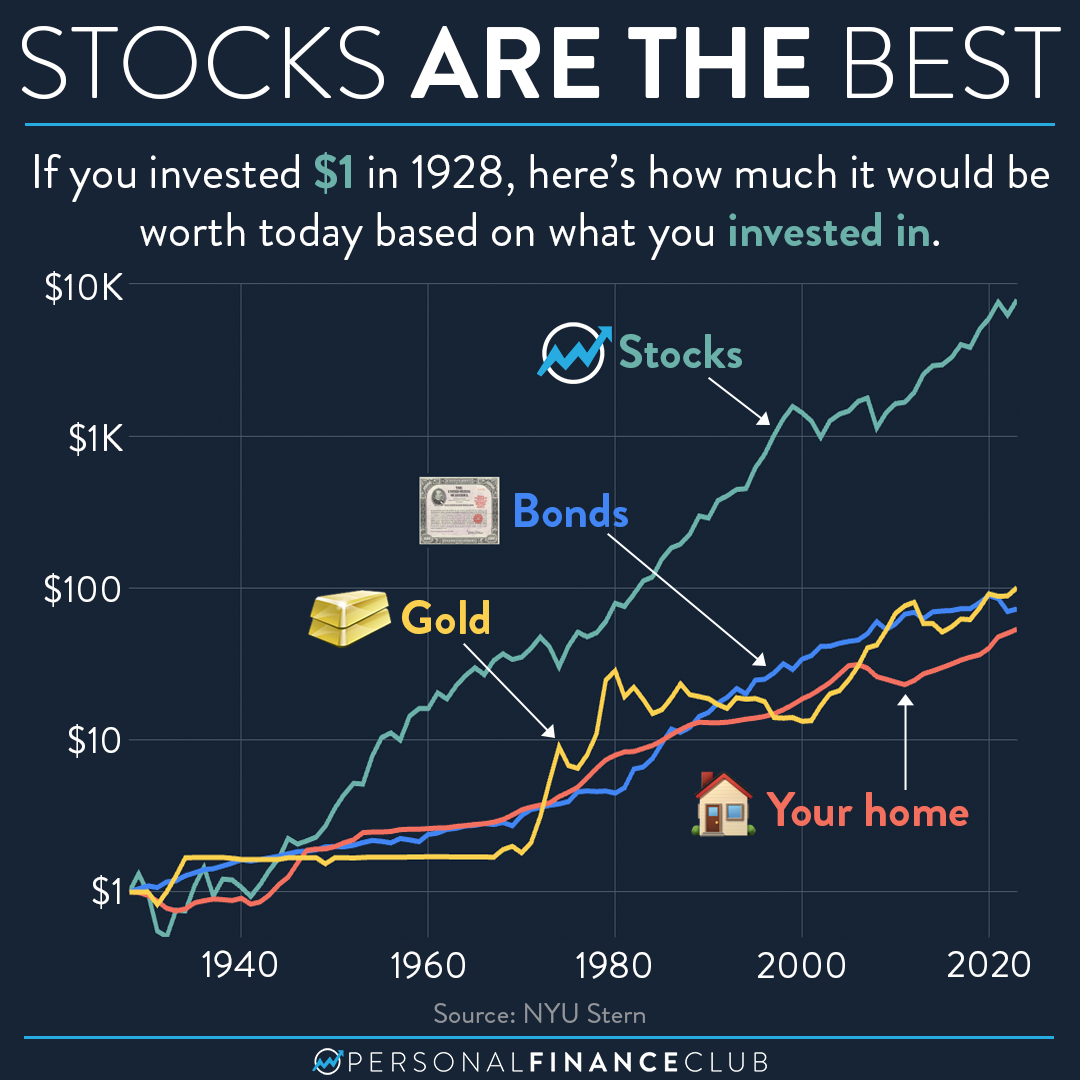

- Risk vs. Reward: Stocks are generally riskier than bonds, but they also offer the potential for higher returns. Bonds, on the other hand, are usually less risky but offer lower returns.

- Ownership: Stocks represent ownership in a company, while bonds represent a debt obligation.

- Income: Stocks may offer dividends, while bonds offer regular interest payments.

- Liquidity: Stocks are generally more liquid than bonds, meaning they can be easily sold on the market.

- Term: Bonds typically have a fixed term, while stocks can be held for any length of time.

Advantages and Disadvantages of Stocks vs. Bonds

Stocks

Advantages:

- Potential for growth: Stocks offer the potential for long-term growth and increased wealth.

- Diversification: Stocks allow investors to diversify their portfolios and spread risk.

- Control: Stockholders have voting rights and can influence the company’s decisions.

Disadvantages:

- Risk: Stocks are generally riskier than bonds and can lose value over time.

- Market volatility: Stocks can be affected by market fluctuations, making them unpredictable.

- No guarantees: Stock returns are not guaranteed and can vary significantly over time.

Bonds

Advantages:

- Lower risk: Bonds are generally less risky than stocks and offer a fixed return.

- Regular income: Bonds provide regular interest payments, making them attractive for income Seekers.

- Guaranteed return: Bond returns are usually guaranteed, providing a fixed income.

Disadvantages:

- Lower returns: Bond returns are generally lower than those offered by stocks.

- Inflation risk: Bonds may lose value over time due to inflation.

- Credit risk: Bond issuers may default on their payments.

Choosing between Stocks and Bonds

So, which should you choose, stocks or bonds? The answer depends on your investment goals and risk tolerance. If you’re looking for growth potential and are willing to take on the associated risks, stocks may be a good choice. However, if you’re seeking a relatively stable, predictable income and are comfortable with lower returns, bonds could be a better option.

Tips for Investing in Stocks and Bonds

- Diversify your portfolio: Spread your investments across a variety of stocks and bonds to minimize risk.

- Set clear investment goals: Determine what you want to achieve with your investments.

- Research and analyze: Take the time to research and analyze potential investments.

- Start with a conservative approach: Consider starting with a conservative investment approach and gradually increasing your risk tolerance as you become more comfortable.

- Consult a financial advisor: Consider consulting a financial advisor for personalized investment advice.

Conclusion

Investing in stocks and bonds requires a basic understanding of their differences. While stocks offer the potential for growth and increased wealth, they are also riskier and less predictable. Bonds, on the other hand, offer a relatively stable, predictable income but lower returns. By understanding the differences between these investment instruments, you can make informed investment choices that align with your goals and risk tolerance.

Recommendations for Further Learning

For a comprehensive understanding of stocks and bonds, consider the following resources:

- Books:

- "A Random Walk Down Wall Street" by Burton G. Malkiel

- "The Intelligent Investor" by Benjamin Graham

- Online resources:

- Investopedia

- The Motley Fool

- Seeking Alpha

- Courses or certifications:

- Chartered Financial Analyst (CFA) program

- Certified Financial Planner (CFP) certification

- Financial advisors:

- Consider consulting a financial advisor for personalized investment advice.

Remember, investing in stocks and bonds requires ongoing education and research to stay up-to-date with market changes and trends.