The world of investing can be intimidating, especially for beginners. With a multitude of options available, it’s crucial to understand the fundamental differences between passive and active investing to make an informed decision. In this article, we’ll delve into the characteristics of both investing approaches, their advantages and disadvantages, and help you determine which one is suitable for your investment goals and risk tolerance.

What is Passive Investing?

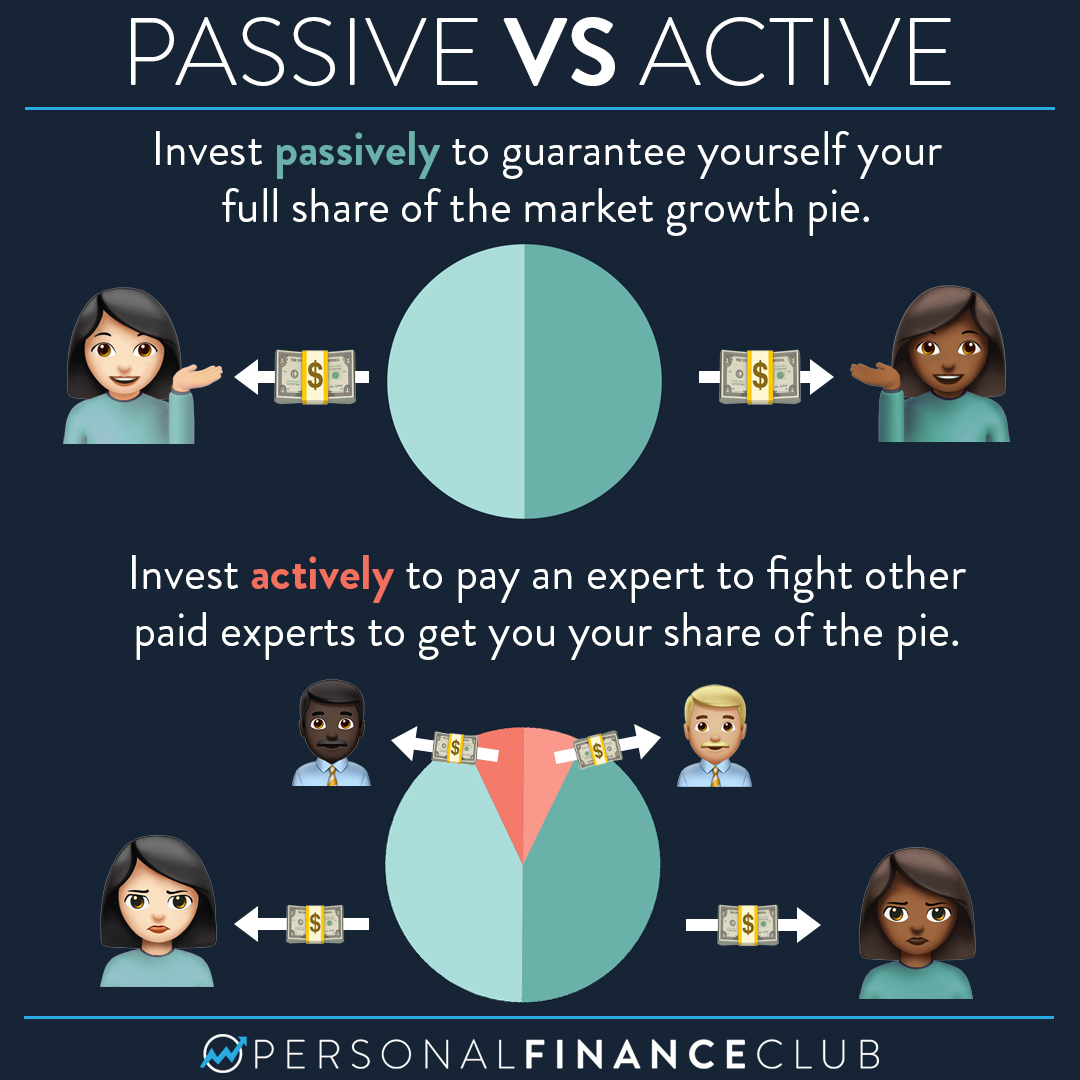

Passive investing, also known as buy-and-hold investing, is an investment strategy that involves buying and holding a diversified portfolio of stocks, bonds, or other securities for extended periods. The primary objective of passive investing is to emulate the performance of a particular market index, such as the S&P 500, without actively trying to beat it. This approach is often associated with low fees, minimal trading, and a reduced risk of underperforming the market.

Characteristics of Passive Investing:

- Diversification: Passive investors aim to spread their investments across various asset classes, sectors, and geographic regions to minimize risk and maximize returns.

- Long-term approach: Passive investing is often employed by investors with a long-term perspective, as they look to ride out market fluctuations and capitalize on the power of compounding.

- Low fees: Passive investment products, such as index funds and ETFs, typically come with lower fees compared to actively managed funds.

- Index tracking: Passive investors seek to mirror the performance of a specific market index, rather than trying to outperform it.

Examples of Passive Investment Options:

- Index Funds: A type of mutual fund that tracks a particular market index, such as the S&P 500 or the MSCI Eafe Index.

- ETFs (Exchange-Traded Funds): A security that represents a portion of a particular market index, such as the S&P 500 or the Russell 2000.

- Dividend Investing: A strategy that focuses on investing in dividend-paying stocks, aiming to generate regular income through dividend payments.

What is Active Investing?

Active investing, on the other hand, involves actively trying to beat the performance of a particular market index by selecting individual stocks, sectors, or asset classes with the potential for higher returns. This approach often requires a high degree of expertise, research, and a willingness to take on more risk.

Characteristics of Active Investing:

- Research-driven: Active investors engage in extensive research to identify and invest in specific stocks, sectors, or asset classes that they believe will outperform the market.

- High turnover: Active investors often trade frequently, aiming to capitalize on market volatility and stay ahead of the competition.

- Higher fees: Active investment products, such as actively managed mutual funds and hedge funds, typically come with higher fees compared to passive investment options.

- Risk-taking: Active investors are often willing to take on greater risk in pursuit of higher returns, which can result in significant losses if their bets don’t pay off.

Examples of Active Investment Options:

- Mutual Funds: A type of investment vehicle that pools money from multiple investors to invest in a variety of assets, such as stocks, bonds, and commodities.

- Hedge Funds: An investment vehicle that pools money from high net worth investors to invest in a variety of assets, such as stocks, bonds, and derivatives.

- Private Investing: An approach that involves investing in private companies, real estate, or other alternative assets, often for high net worth individuals.

Passive Investing vs. Active Investing: A Comparison

| Characteristics | Passive Investing | Active Investing |

|---|---|---|

| Risk tolerance | Low | High |

| Fees | Low | High |

| Trading frequency | Low | High |

| Research requirements | None | Extensive |

| Time horizon | Long-term | Short-term |

| Market tracking | Index tracking | Market-beating |

| Potential returns | Lower | Higher |

| Risk of underperformance | Low | High |

Which Is Right for You?

Ultimately, the decision between passive and active investing depends on your individual investment goals, risk tolerance, and financial profile. Here are some considerations to help you make an informed decision:

- Investment horizon: If you have a long-term perspective, passive investing may be suitable for you. However, if you’re looking for shorter-term results, active investing might be a better fit.

- Risk tolerance: If you’re risk-averse, passive investing can provide a more stable and predictable investment experience. However, if you’re comfortable with higher levels of risk, active investing might be more appealing.

- Fees: If you’re sensitive to fees, passive investing can save you significant amounts of money over time.

- Time commitment: If you have limited time to dedicate to investing research and analysis, passive investing is a great option.

- Investment knowledge: If you have extensive investment knowledge and experience, active investing might be a good fit.

Conclusion

Passive and active investing are two distinct approaches to investing that cater to different investment philosophies and goals. Passive investing offers a low-maintenance, low-fee alternative to actively trying to beat the market. Active investing, on the other hand, requires a high degree of expertise, research, and risk-taking. Ultimately, the right approach for you depends on your individual circumstances, goals, and risk tolerance. By understanding the characteristics of both passive and active investing, you can make an informed decision and develop a long-term investment strategy that aligns with your financial aspirations.

Disclaimer

Investing always involves risk. While passive investing can provide a more stable investment experience, there are no guarantees of returns. Active investing comes with higher potential returns, but also higher potential losses. Before making any investment decisions, consult with a financial advisor or conduct thorough research to determine the best approach for your individual circumstances.