When it comes to investing, one of the most important factors to consider is your risk tolerance. Your risk tolerance is a measure of how much risk you are willing to take on in pursuit of investment returns. It’s a personal assessment of your comfort level with the ups and downs of the market and your ability to withstand potential losses.

In this article, we’ll explore how risk tolerance affects your investment strategy and provide you with the tools and knowledge you need to make informed investment decisions.

Understanding Risk Tolerance

Risk tolerance is a subjective measure that can’t be defined by a specific formula or calculator. It’s a reflection of your individual personality, financial situation, and investment goals. Some people are naturally more conservative and prefer to play it safe, while others are more adventurous and willing to take on risk.

There are several factors that can influence your risk tolerance, including:

- Age: As you get older, your risk tolerance typically decreases. This is because you may have less time to recover from market losses and may be more focused on preserving your wealth.

- Financial situation: If you’re on a tight budget or have high-interest debt, you may be more hesitant to take on risk.

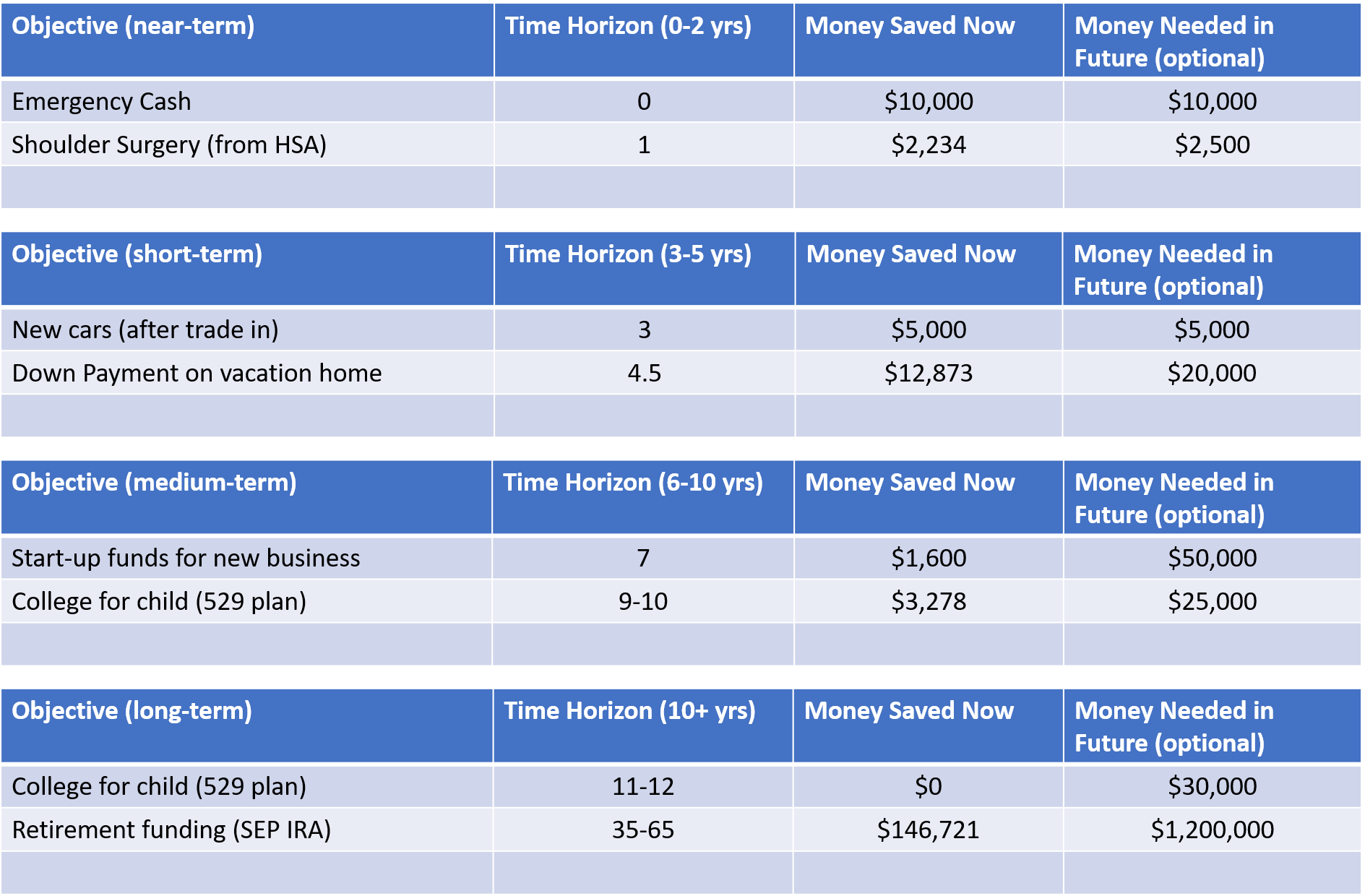

- Investment goals: If you’re investing for long-term goals, such as retirement, you may be more willing to take on risk. However, if you’re investing for shorter-term goals, such as a down payment on a house, you may be more conservative.

- Personal preferences: Some people are naturally more risk-averse or risk-seeking than others.

How Risk Tolerance Affects Your Investment Strategy

Your risk tolerance plays a crucial role in determining your investment strategy. It will help you decide what types of investments are suitable for you, how much you should invest, and how you should diversify your portfolio.

Here are some ways that risk tolerance affects your investment strategy:

- Asset allocation: If you have a high risk tolerance, you may invest a larger portion of your portfolio in stocks, which are generally more volatile than bonds. If you have a low risk tolerance, you may invest more in bonds, which are generally less volatile.

- Investment choices: If you have a high risk tolerance, you may be willing to invest in alternative assets, such as real estate or private equity. If you have a low risk tolerance, you may stick to more traditional investments, such as index funds or ETFs.

- Diversification: If you have a high risk tolerance, you may be willing to take on more risk by investing in a smaller number of securities. If you have a low risk tolerance, you may diversify your portfolio by investing in a larger number of securities.

- Time horizon: If you have a long-term investment horizon, you may be able to ride out market volatility and take on more risk. If you have a shorter-term investment horizon, you may need to be more conservative.

Investment Strategies for Different Risk Tolerances

Here are some investment strategies that are suitable for different risk tolerances:

Conservative Investors

- Money market funds: Invest in money market funds, which offer low returns but are very liquid and low-risk.

- Short-term bonds: Invest in short-term bonds, such as treasury bills or commercial paper, which offer low returns but are very low-risk.

- Dividend-paying stocks: Invest in dividend-paying stocks, which offer a relatively stable source of income.

Moderate Investors

- Index funds: Invest in index funds, which offer broad diversification and relatively low costs.

- ETFs: Invest in ETFs, which offer diversification and flexibility.

- Balanced funds: Invest in balanced funds, which offer a mix of stocks and bonds.

Aggressive Investors

- Growth stocks: Invest in growth stocks, which offer the potential for high returns but are generally more volatile.

- Alternative assets: Invest in alternative assets, such as real estate or private equity, which offer the potential for high returns but are generally more illiquid.

- Direct investment: Invest directly in companies or projects, which offers the potential for high returns but is generally more illiquid.

Monitoring and Adjusting Your Risk Tolerance

Your risk tolerance may change over time due to various factors, such as changes in your financial situation or investment goals. It’s essential to regularly review your investment strategy and adjust your risk tolerance accordingly.

Here are some ways to monitor and adjust your risk tolerance:

- Regularly review your portfolio: Review your portfolio regularly to ensure it’s aligned with your risk tolerance and investment goals.

- Assess your financial situation: Assess your financial situation and investment goals regularly to ensure your investment strategy is still suitable.

- Consider getting professional advice: Consider getting professional advice from a financial advisor or investment advisor to help you adjust your risk tolerance.

Conclusion

Your risk tolerance plays a crucial role in determining your investment strategy. It will help you decide what types of investments are suitable for you, how much you should invest, and how you should diversify your portfolio. By understanding your risk tolerance and adjusting your investment strategy accordingly, you can make informed investment decisions and achieve your financial goals.

Key Takeaways

- Your risk tolerance is a subjective measure of how much risk you are willing to take on in pursuit of investment returns.

- Your risk tolerance can influence your investment strategy, including asset allocation, investment choices, diversification, and time horizon.

- There are several factors that can influence your risk tolerance, including age, financial situation, investment goals, and personal preferences.

- Investment strategies for different risk tolerances include conservative investors, moderate investors, and aggressive investors.

- Monitoring and adjusting your risk tolerance is essential to ensure your investment strategy remains aligned with your financial situation and investment goals.

By understanding how risk tolerance affects your investment strategy, you can make informed investment decisions and achieve your financial goals.

Final Thoughts

Risk tolerance is a personal and subjective measure that requires careful consideration. By understanding your risk tolerance and adjusting your investment strategy accordingly, you can make informed investment decisions and achieve your financial goals. Remember to regularly review your portfolio, assess your financial situation, and consider getting professional advice to ensure your investment strategy remains aligned with your risk tolerance and investment goals.