As an investor, it’s natural to feel anxious about the volatility of the stock market. With prices constantly fluctuating, it can be challenging to predict when the best time to invest is. However, there’s a strategy that can help you navigate these market fluctuations and make the most of your investment: dollar-cost averaging.

In this article, we’ll dive into the world of dollar-cost averaging, exploring what it is, how it works, and why it’s an essential tool for long-term investors. Whether you’re a seasoned pro or just starting out, this strategy can help you achieve your financial goals and reduce your risk exposure.

What is Dollar-Cost Averaging?

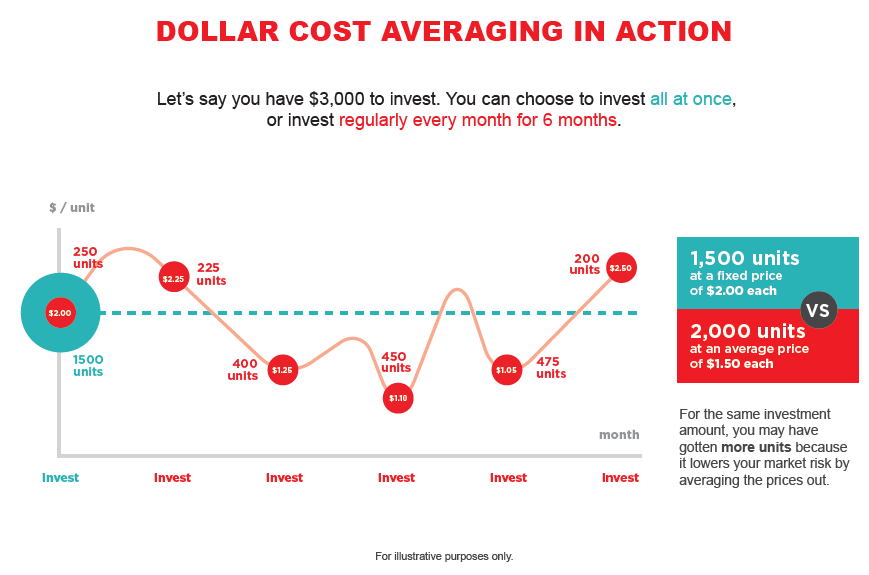

Dollar-cost averaging is an investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the market conditions. This can be done through a variety of investment vehicles, such as mutual funds, exchange-traded funds (ETFs), or individual stocks.

The key principle behind dollar-cost averaging is to invest a set amount of money at predetermined intervals, such as monthly or quarterly. When the market is high, you’ll buy fewer shares than if the market were low, and vice versa. Over time, this strategy can help you tap into the long-term growth potential of the market while minimizing your exposure to market volatility.

Benefits of Dollar-Cost Averaging

So, why is dollar-cost averaging such a popular strategy among long-term investors? Here are just a few of the benefits:

- Reduces Risk: By investing a fixed amount of money at regular intervals, you’ll automate the process of investing and reduce your exposure to market volatility. This can help you avoid making emotional decisions based on market fluctuations.

- Takes Advantage of Long-Term Gains: Dollar-cost averaging is all about capturing long-term growth potential. By investing regularly, you’ll automatically take advantage of market gains over time.

- No Need to Time the Market: With dollar-cost averaging, you won’t need to try to time the market or make guesswork about when to invest or sell. This can be a huge stress-reliever for investors who agonize over market trends!

- Forces Discipline: By investing a fixed amount of money at regular intervals, you’ll create a discipline around your investments that can help you stick to your goals.

- Less Emotional: Dollar-cost averaging is a more emotional-neutral approach to investing, which can help reduce anxiety and stress around market fluctuations.

How Dollar-Cost Averaging Works

To implement dollar-cost averaging, you can follow these simple steps:

- Set a Budget: Determine how much you’re willing to invest each month or quarter, and stick to it.

- Choose an Investment Vehicle: Select a mutual fund, ETF, or individual stock that aligns with your investment goals and risk tolerance.

- Set up Automated Investments: Set up a system to automatically invest a fixed amount of money at regular intervals, such as through a brokerage account or robo-advisor.

- Monitor and Adjust: Periodically review your investments and rebalance your portfolio as needed, but only make adjustments based on your long-term investment goals, not market fluctuations.

Example: Dollar-Cost Averaging in Action

Let’s say you want to invest $500 per month in the S&P 500 index fund over a 5-year period. Assuming an average return of 7% per year, here’s how dollar-cost averaging could work:

| Month | Market Value | Shares Purchased | Total Cost |

|---|---|---|---|

| 1 | $1,000 | 80 shares | $500 |

| 2 | $1,150 | 72 shares | $500 |

| 3 | $1,100 | 79 shares | $500 |

| 4 | $1,050 | 82 shares | $500 |

| 5 | $1,200 | 70 shares | $500 |

As you can see, the monthly investment remains the same ($500), but the number of shares purchased varies based on the current market value. Over time, this can help you take advantage of market gains while minimizing your exposure to volatility.

Common Misconceptions about Dollar-Cost Averaging

While dollar-cost averaging can be a powerful strategy, there are some common misconceptions that might deter you from trying it:

- Myth: Dollar-cost averaging is a short-term strategy. Reality: Dollar-cost averaging is a long-term strategy, designed to ride out market fluctuations and capture long-term growth potential.

- Myth: I can time the market and beat the averages. Reality: Market timing is a flawed strategy, and dollar-cost averaging is a more reliable and disciplined approach to investing.

- Myth: I’ll lose money if I invest during a downturn. Reality: Dollar-cost averaging can actually help you take advantage of market downturns by investing at lower prices.

Real-Life Examples of Dollar-Cost Averaging

Dollar-cost averaging has been employed by some of the most successful investors in history. Here are a few notable examples:

- John Bogle: The founder of Vanguard is famous for his support of dollar-cost averaging, which he believes can help investors beat the market over time.

- Warren Buffett: The billionaire investor has long advocated for dollar-cost averaging, citing its ability to help investors accumulate wealth over the long-term.

- Seth Klarman: The founder of Baupost Group advocates for dollar-cost averaging, believing it can help investors avoid euphoria and panic during market downturns.

Implementing Dollar-Cost Averaging in Your Portfolio

So, how can you start employing dollar-cost averaging in your own investments? Here are some tips:

- Start Small: Begin by investing a fixed amount of money at regular intervals, even if it’s just $100 per month.

- Automate Your Investments: Set up a system to automatically invest a fixed amount of money at regular intervals, such as through a brokerage account or robo-advisor.

- Review and Rebalance: Periodically review your investments and rebalance your portfolio as needed, but only make adjustments based on your long-term investment goals, not market fluctuations.

- Seek Professional Advice: If you’re new to dollar-cost averaging, it may be helpful to seek advice from a financial advisor or investment professional.

Conclusion

Dollar-cost averaging is a powerful strategy for long-term investors, offering a disciplined and stress-reducing approach to investing in the market. By investing a fixed amount of money at regular intervals, you can take advantage of market gains while minimizing your exposure to volatility. Don’t let market fluctuations get in the way of your financial goals – give dollar-cost averaging a try today!

Additional Resources

If you’re interested in learning more about dollar-cost averaging, here are some additional resources to explore:

- Books:

- "The Little Book of Common Sense Investing" by John C. Bogle

- "The Intelligent Investor" by Benjamin Graham

- "Security Analysis" by Benjamin Graham and David Dodd

- Websites:

- Bogleheads.org: A community-driven website dedicated to providing education and resources on dollar-cost averaging and investing.

- Investopedia.com: A comprehensive online resource on investing and personal finance.

- Podcasts:

- "The Dave Ramsey Show" podcast: Offers advice and resources on personal finance and investing.

- "The Tim Ferriss Show" podcast: Features interviews with successful entrepreneurs and investors on dollar-cost averaging and investing.

Remember, investing is a marathon, not a sprint. With dollar-cost averaging, you can create a disciplined and stress-free approach to investing that will help you achieve your long-term financial goals.