Index funds have become a popular investment option in recent years, and for good reason. They offer a low-cost, diversified way to invest in the stock market, with the potential for steady returns over the long term. In this article, we’ll take a closer look at index funds, how they work, and provide a step-by-step guide on how to invest in them.

What are Index Funds?

Index funds are a type of mutual fund that tracks a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. They hold a portfolio of stocks or bonds that are designed to replicate the performance of the underlying index. By doing so, index funds offer investors a way to gain broad market exposure, without the need for extensive research or focus on individual stocks.

Benefits of Index Funds

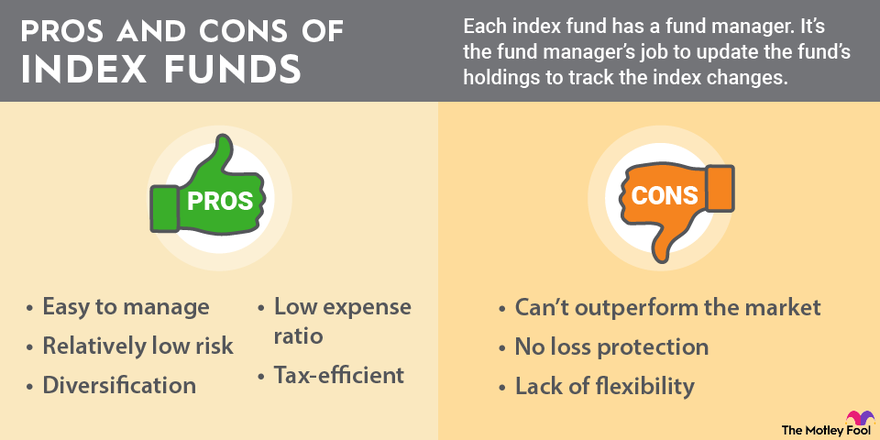

So, why choose index funds over other investment options? Here are some of the key benefits:

- Diversification: Index funds offer instant diversification, which can help to reduce risk and increase returns. By holding a portfolio of stocks or bonds, investors can spread their risk and capture the benefits of a broad market exposure.

- Low Costs: Index funds are generally cheaper than actively managed funds, which can save investors money in fees and expenses over the long term.

- Consistency: Index funds tend to be less volatile than actively managed funds, as they track a specific market index. This can provide a more consistent investment experience, even in turbulent markets.

- Transparency: Index funds are designed to track a specific market index, which means that investors can easily see the holdings and performance of the fund.

How to Choose an Index Fund

With so many index funds to choose from, how do you decide which one is right for you? Here are some factors to consider:

- Investment Objective: What are your investment goals? If you’re looking for long-term growth, a total stock market index fund may be a good option. If you’re looking for income, a bond index fund may be a better choice.

- Risk Tolerance: How much risk are you willing to take on? If you’re conservative, you may want to consider a more conservative index fund, such as a bond or balanced index fund.

- Fees: Compare fees across different index funds to ensure you’re getting the best deal.

- Track Record: Look for index funds with a strong track record of performance over the long term.

Popular Index Fund Options

Here are some popular index fund options to consider:

- Vanguard Total Stock Market Index Fund (VTSAX): Tracks the CRSP US Total Market Index and holds a portfolio of over 3,000 US stocks.

- Schwab U.S. Broad Market ETF (SCHB): Tracks the Dow Jones U.S. Broad Stock Market Index and holds a portfolio of over 2,500 US stocks.

- iShares Core S&P 500 ETF (IVV): Tracks the S&P 500 Index and holds a portfolio of the largest 500 US stocks.

How to Invest in Index Funds

Investing in index funds is relatively straightforward. Here are some steps to follow:

- Choose a Brokerage Account: You’ll need to open a brokerage account with a reputable online broker, such as Vanguard, Fidelity, or Schwab.

- Research Index Funds: Choose the index fund(s) that best fit your investment objectives and risk tolerance.

- Open a Trading Account: Once you’ve chosen your index fund, you’ll need to open a trading account with the same brokerage firm.

- Fund Your Account: Deposit money into your trading account to invest in the index fund.

- Invest in the Index Fund: Use the money in your trading account to invest in the index fund.

Tax-Efficient Investing with Index Funds

When it comes to taxes, index funds can be a tax-efficient way to invest. Here are some tips to keep in mind:

- Hold Index Funds Long-Term: Long-term capital gains are generally taxed at a lower rate than short-term capital gains.

- Choose Tax-Deferred Accounts: Consider investing in tax-deferred accounts, such as 401(k) or IRA, to delay taxes on your investments.

- Avoid Frequent Trading: Try to avoid frequent trading, as this can trigger short-term capital gains and increase tax liability.

Common Mistakes to Avoid When Investing in Index Funds

While index funds can be a great investment option, there are some common mistakes to avoid:

- Not Diversifying: Make sure to diversify your portfolio by holding a mix of different asset classes, such as stocks, bonds, and real estate.

- Not Monitoring Fees: Keep an eye on fees across different index funds to ensure you’re getting the best deal.

- Not Reviewing Performance: Regularly review the performance of your index fund to ensure it’s meeting your investment objectives.

Conclusion

Index funds offer a low-cost, diversified way to invest in the stock market, with the potential for steady returns over the long term. By following the steps outlined in this article, you can get started with investing in index funds today. Remember to choose a brokerage account, research index funds, and fund your account to start investing. With the right strategy and a long-term perspective, index funds can be a great way to build wealth and achieve your financial goals.

Recommended Resources

- Vanguard: Vanguard offers a range of index funds and ETFs that are designed to track various market indices.

- Fidelity: Fidelity offers a range of index funds and ETFs that are designed to track various market indices.

- Schwab: Schwab offers a range of index funds and ETFs that are designed to track various market indices.

- The Bogleheads: The Bogleheads is a online community that provides resources and information on investing in index funds and ETFs.

Disclaimer

This article is for informational purposes only and should not be considered investment advice. Investing in index funds carries risk and may not be suitable for all investors. It’s always a good idea to consult with a financial advisor or professional before making investment decisions.