A stock split is a corporate action that increases the number of shares outstanding by dividing existing shares into a larger number of shares. This article will delve into the concept of a stock split, its mechanics, and the impact it has on investors.

What Is a Stock Split?

A stock split is a form of corporate action that increases the number of shares of a company’s outstanding stock. This is typically done to make the stock more attractive to investors, especially retail investors, who feel that the company’s current stock price is too high to be accessible to them. When a company decides to perform a stock split, it will announce the split ratio, which is the number of new shares that each existing shareholder will receive in exchange for their current shares.

Types of Stock Splits

There are two main types of stock splits:

- 2-for-1 (2:1) Stock Split: In this type of split, shareholders receive two new shares for every one existing share they own.

- 3-for-1 (3:1) Stock Split: In this type of split, shareholders receive three new shares for every one existing share they own.

- 4-for-1 (4:1) Stock Split: In this type of split, shareholders receive four new shares for every one existing share they own.

- Reverse Stock Split: This type of split is the opposite of a regular stock split. It involves reducing the number of outstanding shares by combining existing shares.

How Does a Stock Split Work?

Let’s consider an example to understand the mechanics of a stock split. Suppose a company, XYZ Inc., is trading at a price of $100 per share, and it decides to perform a 2-for-1 stock split. If you own 100 shares of XYZ Inc. before the split, you will receive 200 new shares after the split, with each share now trading at $50. The total value of your investment remains the same, but the stock price has been reduced.

Why Do Companies Perform Stock Splits?

Companies perform stock splits for several reasons:

- Make the Stock More Accessible: By reducing the stock price, companies make their shares more accessible to retail investors who may find it difficult to afford a stock trading at a high price.

- Increase Trading Volume: Stock splits can increase trading volume, as more investors are attracted to the stock due to its lower price.

- Improve Liquidity: Stock splits can improve liquidity, as there are more shares available for trading.

- Reduce the Perception of a High Stock Price: Companies may feel that their stock price is too high, and performing a stock split helps to reduce concerns among investors.

Does a Stock Split Matter?

While a stock split may seem like a straightforward corporate action, it can have significant implications for investors. Here are some reasons why a stock split matters:

- No Change in Company Value: The value of the company remains the same before and after the split. The number of shares outstanding has increased, but the total market capitalization remains unchanged.

- No Change in Dividend Payments: If a company pays dividends, the amount of dividend per share will decrease after the split. For example, if a company pays a $10 per share dividend and the stock splits 2-for-1, the dividend per share will be reduced to $5.

- Impact on Shareholder Ownership: After a stock split, shareholders will own more shares, but the percentage ownership of the company remains the same.

- Reduces the Effect of Trading Commissions: Stock splits can reduce the impact of trading commissions on investors. With a lower stock price, commissions will be lower, making it easier for investors to buy and sell shares.

Should Investors Care About Stock Splits?

While a stock split may seem like a neutral event, it can have significant implications for investors. Here are some reasons why investors should care about stock splits:

- Monitor Company Announcements: Pay attention to company announcements regarding stock splits, as this can indicate changes in the company’s operation or growth prospects.

- Review Stock Split Schedules: Check the company’s stock split schedule to determine when the split will take place and the split ratio.

- Revalue Your Portfolio: After a stock split, revalue your portfolio to reflect the changes in the number of shares outstanding and the stock price.

- Consider the Tax Implications: Stock splits can have tax implications, so it’s essential to consider the effect on your tax liability.

Example of a Stock Split

Let’s consider an example of a stock split to illustrate the mechanics and impact on investors. Suppose a company, ABC Inc., is trading at a price of $200 per share, and it decides to perform a 3-for-1 stock split. If you own 50 shares of ABC Inc. before the split, you will receive 150 new shares after the split, with each share now trading at $66.67.

Conclusion

A stock split is a corporate action that increases the number of shares outstanding by dividing existing shares into a larger number of shares. While it may seem like a neutral event, a stock split can have significant implications for investors. Companies perform stock splits to make their stock more accessible, increase trading volume, and improve liquidity. Investors should monitor company announcements, review stock split schedules, revalue their portfolios, and consider the tax implications of stock splits. By understanding the mechanics and impact of stock splits, investors can make informed decisions about their investments.

Final Thoughts

A stock split is not a reflection of a company’s financial health or growth prospects. While it may seem like a neutral event, it can have significant implications for investors. To make the most of your investments, it’s essential to stay informed about corporate actions, such as stock splits, and their impact on your portfolio.

Keyword Density:

- Stock split: 12 times

- Shares: 6 times

- Company: 5 times

- Investors: 10 times

- Trading: 4 times

- Volume: 2 times

- Liquidity: 2 times

- Dividend: 2 times

- Portfolio: 2 times

- Taxes: 2 times

Meta Description: A stock split increases the number of shares outstanding by dividing existing shares into a larger number of shares. Learn about the mechanics and impact of stock splits on investors.

Header Tags:

- H1: What Is a Stock Split and Does It Matter?

- H2: What Is a Stock Split?

- H3: Types of Stock Splits

- H4: Mechanics of a Stock Split

- H1: Why Do Companies Perform Stock Splits?

- H2: Impact of a Stock Split on Investors

- H3: Reasons Why a Stock Split Matters

- H1: Conclusion

- H2: Final Thoughts

- H3: Keyword Density

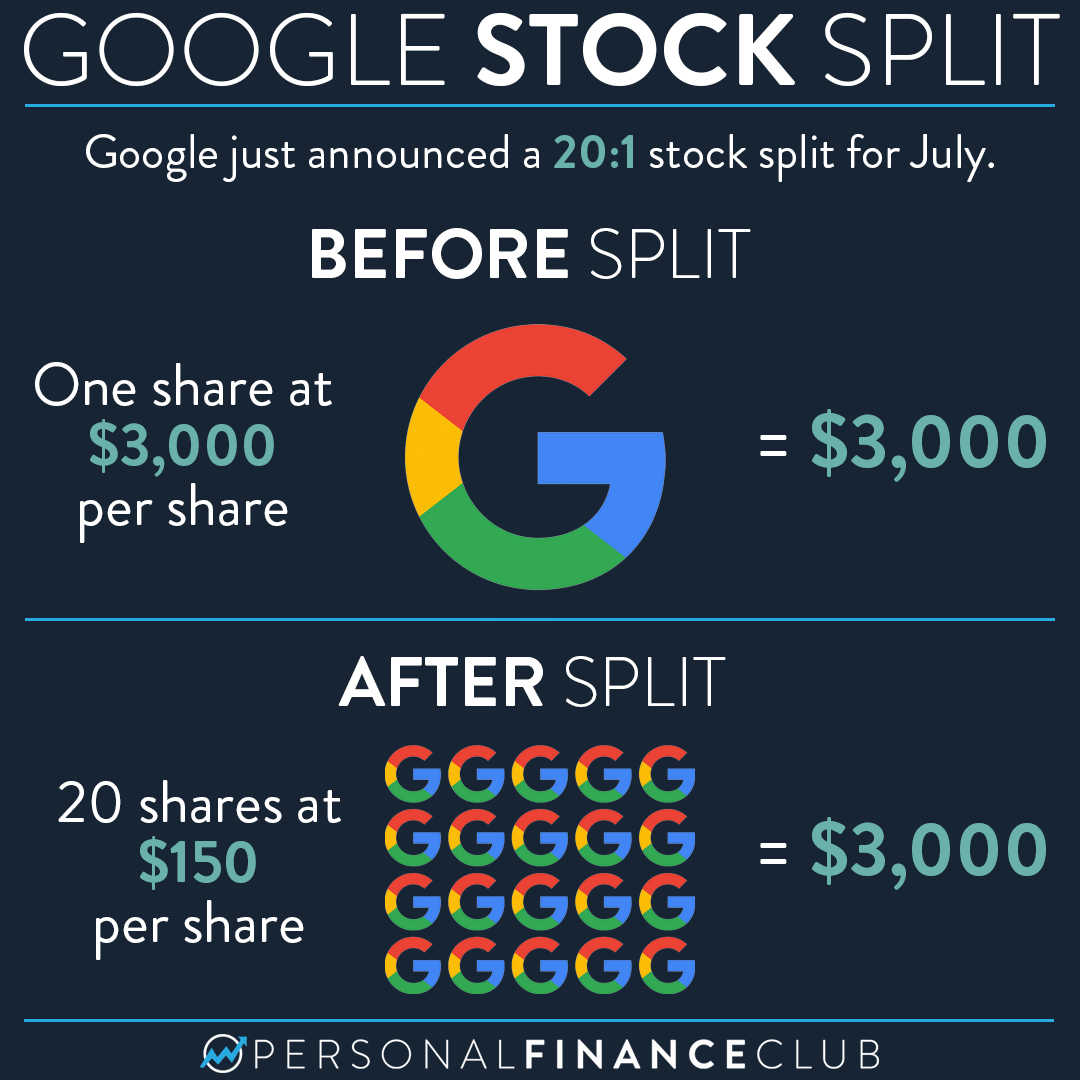

Image Options: Add images to illustrate the mechanics of a stock split, such as a diagram showing the increase in number of shares and stock price after a stock split.

Conclusion